unemployment tax break refund tracker irs

How to claim an unemployment tax refund and how to check the IRS payment status The American Rescue Plan provided a significant tax break for those who received unemployment. Refund for unemployment tax break.

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a.

. He IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective. Through its network of regional Veterans Service offices the Division of Veterans Programs provides the states 712000 veterans and their dependents with information and guidance in filing claims for any benefits they may be entitled. The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support.

The tax break is for those who earned less than 150000 in adjusted gross income. IRS TAX REFUND. IRS unemployment refund update.

You typically dont need to file an amended return in order to get this potential refund. Refunds started going out the week of May 10 according to the IRS and will run through the summer as the agency evaluates tax returns. The IRS began to send out the additional refund checks for tax withheld from unemployment in May.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Unemployment 10200 tax break. Refunds set to start in May Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment benefits could be getting a.

Not everyone will receive a refund. How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid. However if you havent yet filed your tax return you should report this reduction in unemployment income on your Form 1040.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. IR-2021-159 July 28 2021.

More complicated returns could take longer to process. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Added April 29 2021 A4. If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a check or deposit the payment in your bank account. The deadline to file your federal tax return was on May 17.

This means if they have one coming to them than most who filed an individual tax return. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was applicable for. Trained veterans service officers at those offices are available to assist veterans with issues pertaining to.

Unpaid debts include past-due federal tax state income tax state unemployment compensation debts child support spousal support or certain federal nontax debts such as student loans. Instead the IRS will adjust the tax return youve already submitted. If the exclusion adjustment results in a refund will the IRS use the refund to pay offset any unpaid debts I may have.

An immediate way to see if the irs processed your refund and for how much is by viewing your tax records online. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went into effect. To follow the progress of your refund enter your Social Security number and the amount of the refund as listed on your tax return.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

Then select the appropriate tax year. Luckily the millions of people who are getting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became law can track their refund with this IRS tool. TAX SEASON 2021.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break. The 10200 is the amount of income exclusion for single filers not. Irs Unemployment Tax Refund Status Tracker The irs has sent 87 million unemployment compensation refunds so far.

That law waived taxes on up to 10200 in unemployment insurance benefits for individuals earning less than 150000 a year. MyIdea Irs Unemployment Tax Refund Status Tracker. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American.

The 10200 is the amount of income exclusion for single filers. 2021 2020 Before checking on your refund wait four weeks from the day you filed an electronic online return. The refunds are being sent out in batchesstarting with the.

How To Find Your Irs Tax Refund Status H R Block Newsroom

![]()

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More

Still Waiting For A Tax Refund Irs Backlog Of 35 Million Returns May Be To Blame Wfla

Irs Sends Out 1 5 Million Surprise Tax Refunds

Tax Refund Delays 9 Main Reasons Why Your Irs Money Hasn T Arrived Cnet

Tax Refund Timeline Here S When To Expect Yours

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

14 4 Billion Worth Of Tax Refunds Finally Given To Eligible Taxpayers Irs To Distribute 1 600 Refunds Each Before The Year Ends The Republic Monitor

How To Find Out Your Tax Refund Status Tax Refund Irs Taxes Tax

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Tax Refund Timeline Here S When To Expect Yours

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca

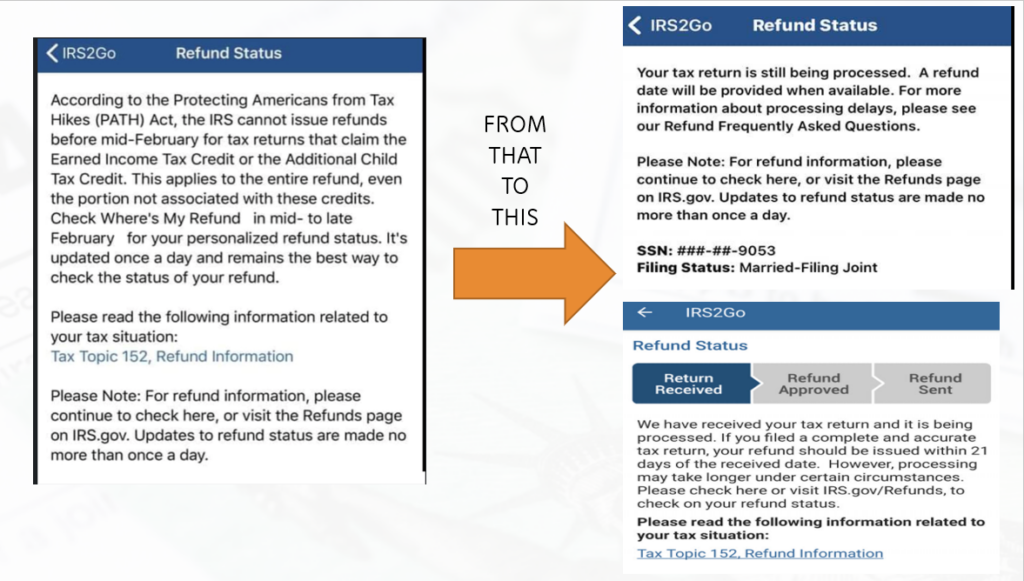

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest